This is a partial check that each and every transaction has been correctly recorded. How to Do Small Business Accounting.

Solved When A Company Records Depreciation It Debits Chegg Com

The company added 165 to its accounting records when it should have added only 156.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

. This is the final step before the. As a result the company must subtract 9 from its Cash balance. Accounting helps you gauge the health and value of the company to make better decisions about short- and long-term success.

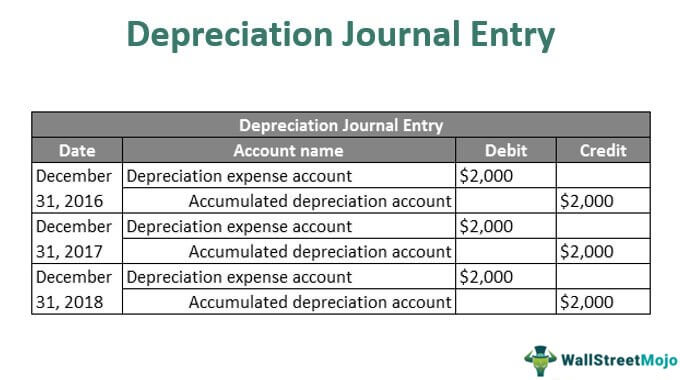

Examples of Payroll Journal Entries For Wages. Accountants record increases in asset expense and owners drawing accounts on the debit side and they record increases in liability revenue and owners capital accounts on the credit side. Adjusting entries are made for accrual of income and expenses depreciation allowances deferrals and prepayments.

Open a dedicated bank account to separate your business finances from your personal. Each financial transaction is recorded in at least two different nominal ledger accounts within the financial accounting system so that the total debits equals the total credits in the general ledger ie. Debits abbreviated Dr always go on the left side of the T and credits abbreviated Cr always go on the right.

In other words it added 9 too much to its Cash balance. Once the adjusting entries are made an adjusted trial balance must be prepared. Receive instant access to our graded Quick Tests more than 1800 unique test questions when you join AccountingCoach PRO.

The transaction is recorded as a debit entry Dr in one account and a. The account title and account number appear above the T. In the following examples we assume that the employees tax rate for Social Security is 62 and that the employers tax rate is 62.

This is done to test if the debits match the credits after the adjusting entries are made. Open a Separate Bank Account. Want more practice questions.

In this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages payroll withholdings and employer costs related to payroll. Heres how to set up the basic accounting cycle for your small business.

Depreciation Journal Entry Step By Step Examples

Straight Line Depreciation Accountingcoach

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Chart Of Accounts Is Simply A List Of Account Names That A Company Uses In Its General Ledger For Recor Accounting Education Accounting Basics Accounting Notes

0 Comments